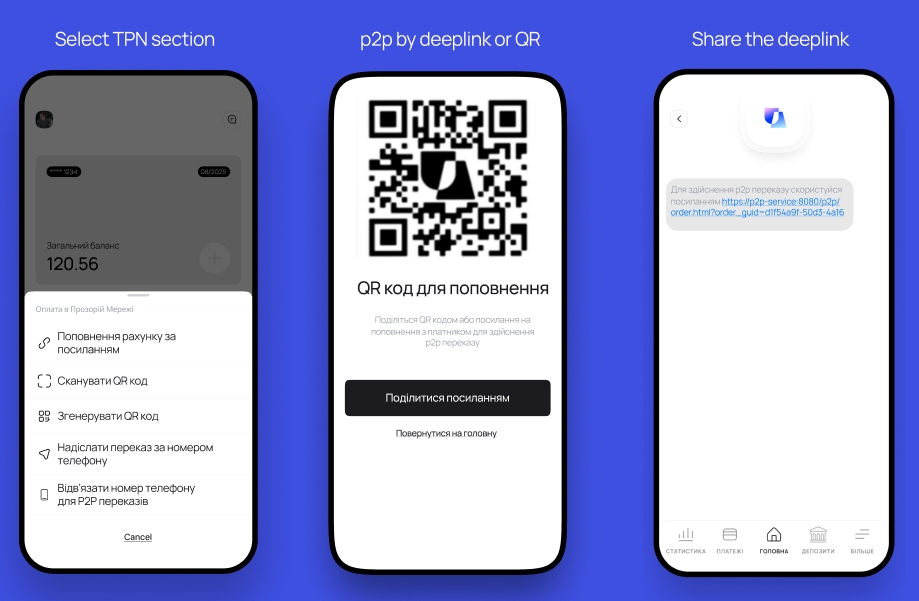

🖇️p2p by deeplink or QR code

Unlike alias-based payments, P2P via link is initiated by a client who wishes to receive funds into their account using a QR code or deeplink.

To do this, the client accesses their bank’s mobile application and selects the account funding via link option within the DCM platform. In response to this request, the following are generated:

QR Code – displayed for the payer, allowing them to scan it using their phone’s camera or bank app.

Deeplink – a payment link that can be sent to the payer via SMS or a messaging app.

During the generation of the QR code or deeplink, the Transparent Network, based on a request from the recipient’s bank, creates a funding order.

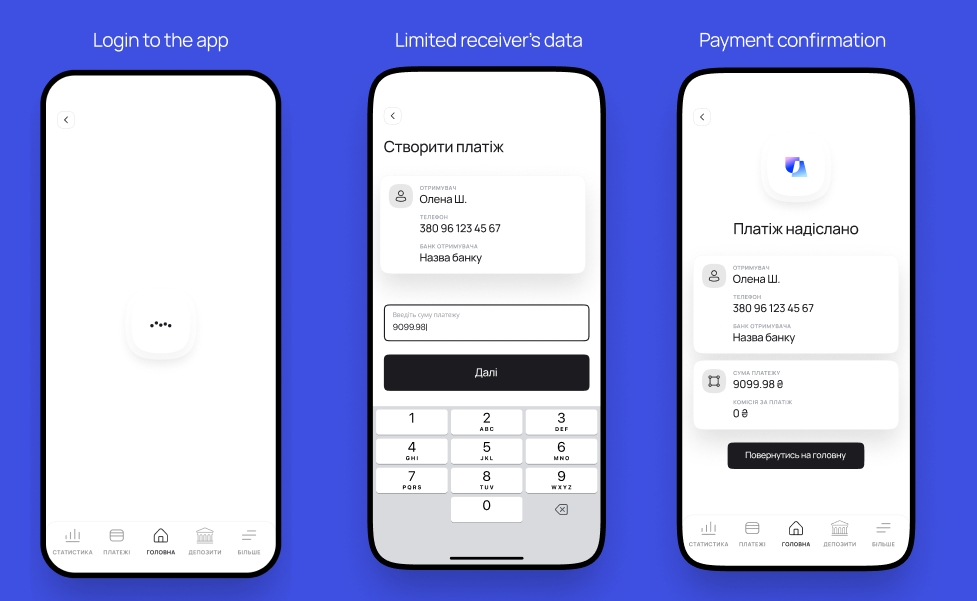

When the Payer Scans the QR Code or Clicks the Deeplink:

They are redirected to their mobile banking app (or a deeplink page if scanning the QR code with their phone’s camera).

They see limited information about the recipient.

They can enter the payment amount.

After verifying the payment details and debiting (or blocking) funds from their account, the initiating bank sends a payment notification to the DCM platform. The DCM platform validates the transaction details and generates a "pay-in" callback to the recipient’s bank with payment data.

The recipient’s bank validates and confirms the successful processing of the callback and credits the recipient’s account. The initiating bank receives a final "pay-out" callback, allowing it to generate a payment instruction for the final fund settlement.

As mentioned above, the DCM platform provides the capability to exchange payment information. The actual movement of funds between banks is carried out through the existing internal banking instrument. Banks that are registered participants of the DCM platform receive real-time payment notifications.

The main integration points for the bank are shown below:

POST/pay_request

Callback "Pay_request"

POST/Payment-message

Callback "Pay-out" Depending on the clearing model:

Callback "Gross_Settlement" (optional)

GET/Gross_settlement_list

GET/Gross_settlement_by_id

POST/Gross_settlement_pay

POST/Gross_settlement_confirm

POST/p2p_order

GET/creditor's_data

Callback "Pay-in" Depending on the clearing model:

Callback "Gross_Settlement"(optional)

GET/Gross_settlement_list

GET/Gross_settlement_by_id

Last updated