📲p2p by phone number

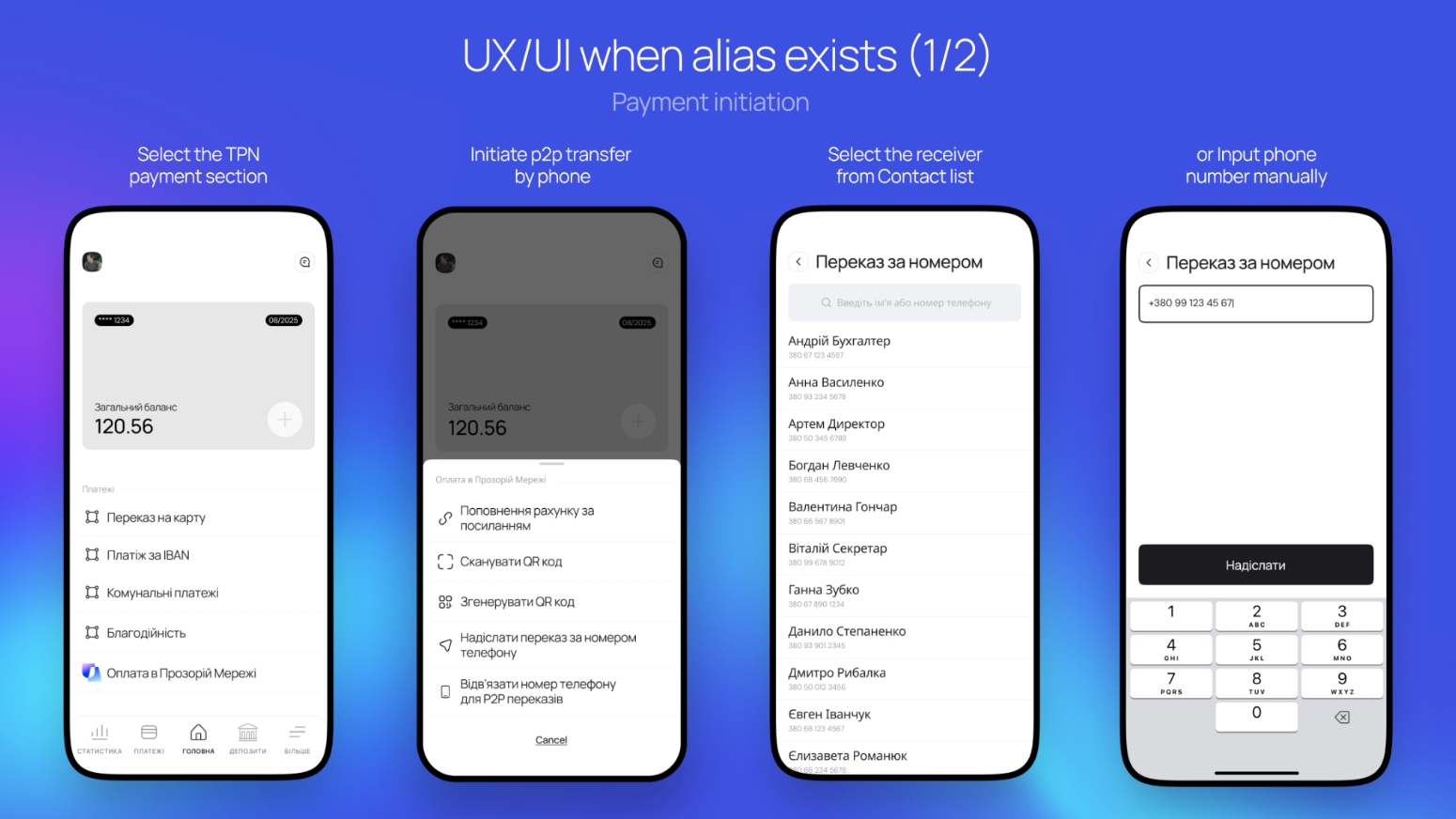

The payment by phone number is initiated by the client using the functionality of the initiating bank's mobile application. The client can choose the recipient's phone number from their "Contacts" or enter it manually.

After the client confirms the entered details, the initiating bank contacts the DCM platform to create a payment order.

Based on the order, the DCM platform queries the alias database to find the recipient by phone number:

If the alias is in the database

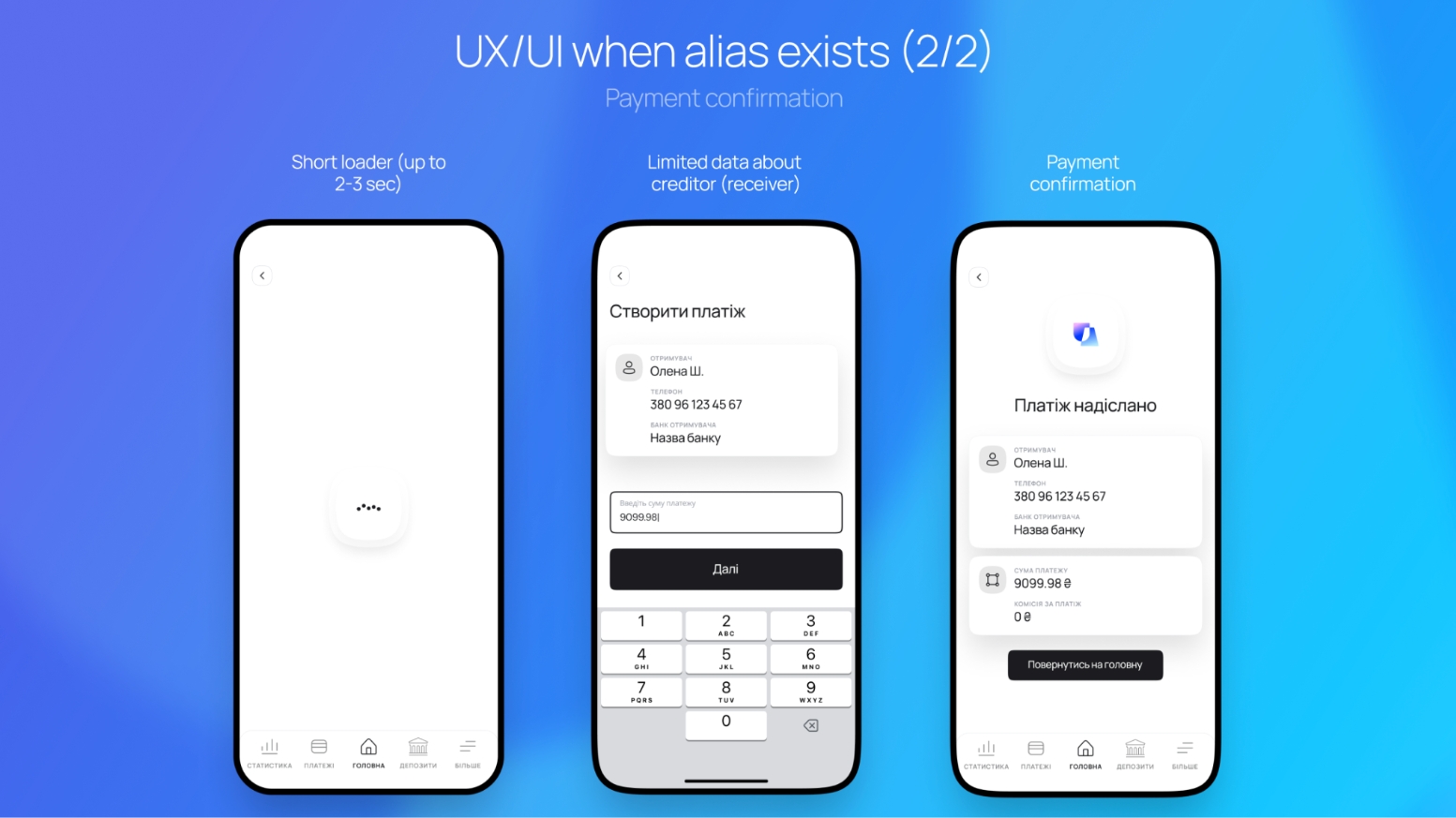

The DCM platform sends a request to the recipient's bank to obtain encrypted data about the recipient.

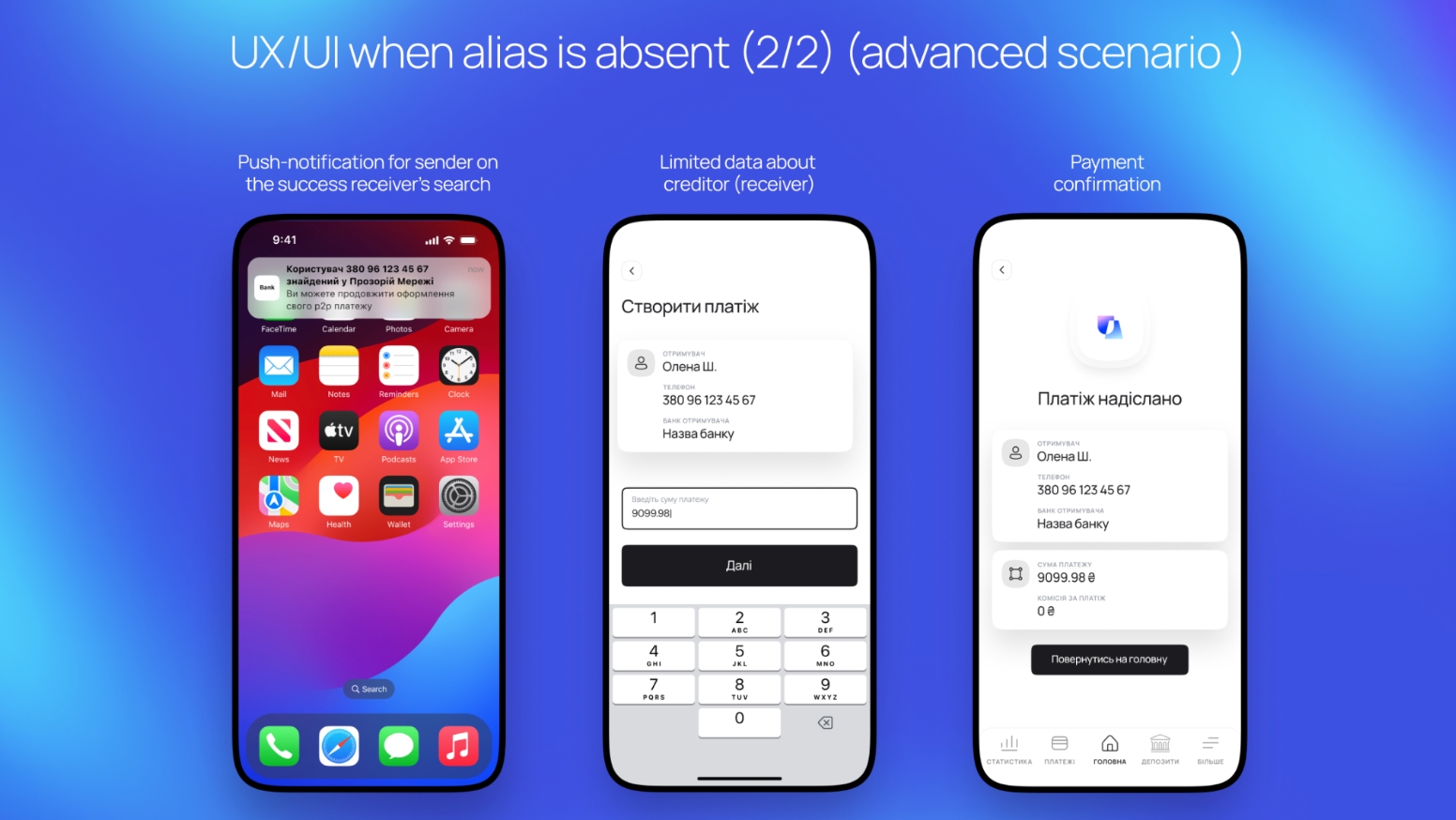

The obtained data is transmitted to the initiating bank, which decrypts it and displays limited information about the recipient to the payer for payment confirmation.

After verifying the payment parameters and debiting (or blocking) funds from the client's account, the initiating bank sends a payment notification to the DCM platform.

The DCM platform validates the accuracy of the notification data and generates a "pay-in" callback to the recipient's bank with payment details.

The recipient's bank validates and confirms the successful processing of the callback and credits the recipient's account.

The initiating bank receives the final "pay-out" callback, which allows it to generate a payment instruction for the final settlement of funds.

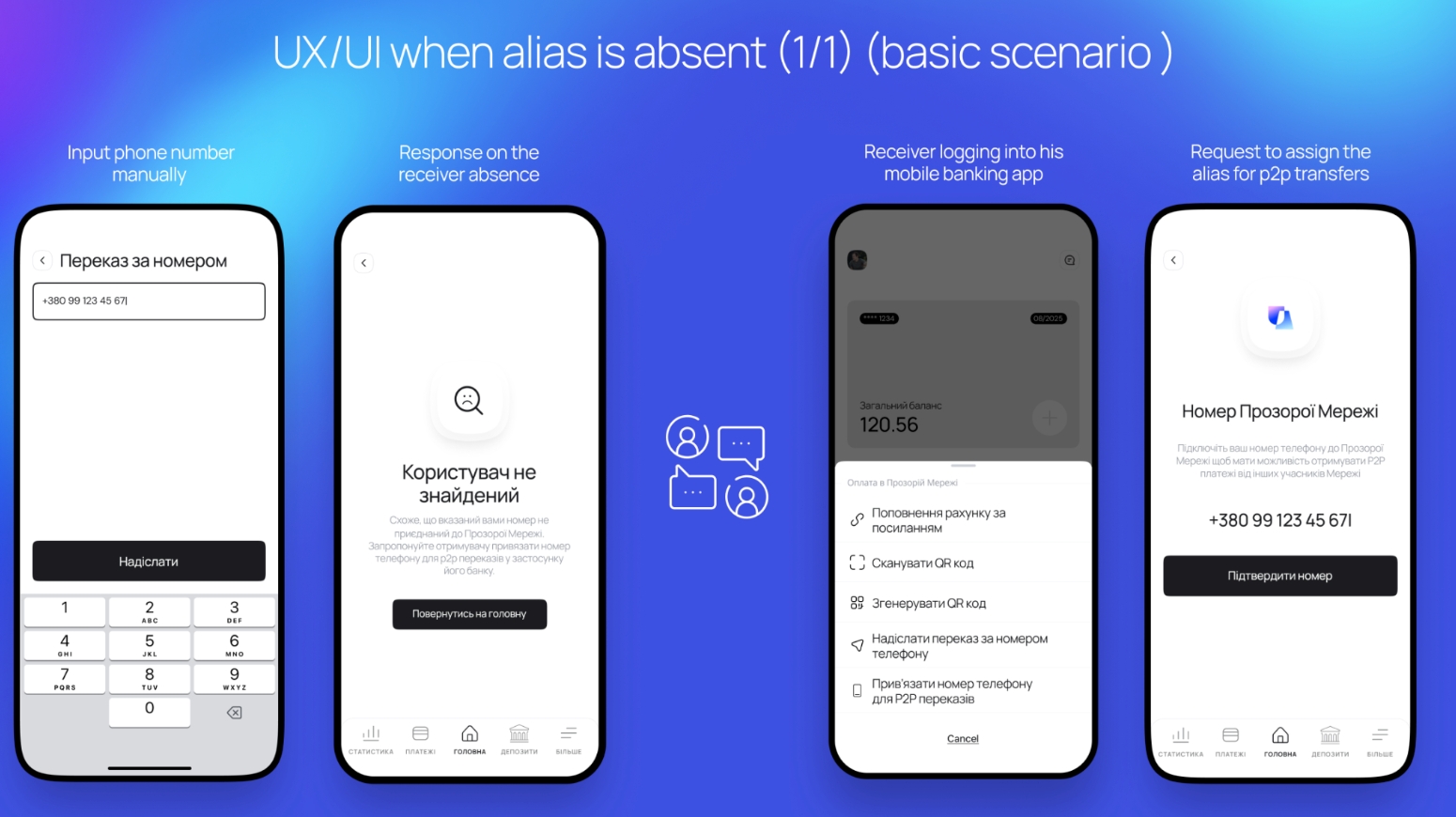

If the alias is not in the database

The DCM platform sends a request to participating banks to check the number in their customer database. If the client is not found, the banks notify the DCM platform accordingly.

If the number is found, the recipient's bank notifies the DCM platform and initiates a request in the client's mobile application to confirm the use of this number for receiving P2P payments.

If the client agrees, the bank notifies the DCM platform.

Based on the received confirmation, the phone number and IBAN are added to the alias database. The subsequent process proceeds in the same way as for an alias that is already in the database.

As mentioned above, the DCM platform provides the capability to exchange payment information. The actual movement of funds between banks is carried out through the existing internal banking instrument. Banks that are registered participants of the DCM platform receive real-time payment notifications.

The main integration points for the bank are shown below:

POST/p2p_order

Callback "Pay_request"

POST/Payment-message

Callback "Pay-out" Depending on the clearing model:

Callback "Gross_Settlement" (optional)

GET/Gross_settlement_list

GET/Gross_settlement_by_id

POST/Gross_settlement_pay

POST/Gross_settlement_confirm

POST/link_creditor

Callback "Linked_creditor"

GET/creditor's_data

Callback "Pay-in" Depending on the clearing model:

Callback "Gross_Settlement"(optional)

GET/Gross_settlement_list

GET/Gross_settlement_by_id

Last updated